- Grey market products pose significant threat to Sri Lanka’s fiscal health

(LANKAPUVATH | COLOMBO) – Unauthorised grey market imports are causing a significant dent in Sri Lanka’s tax revenue. The allure of lower prices for consumers masks a troubling reality where the nation’s economic stability and consumer safety are at stake.

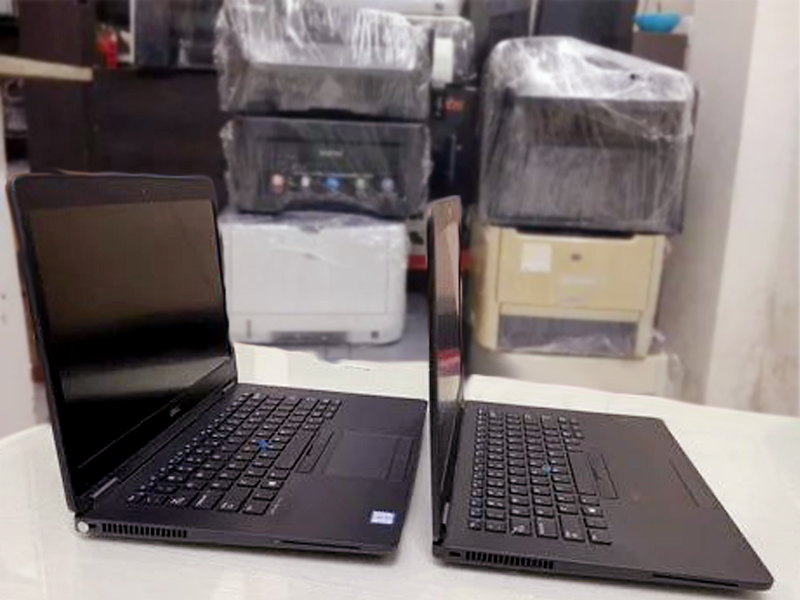

The practice of importing branded products without the consent of trademark owners, known as grey market or parallel imports, has led to substantial losses in tax revenue and foreign exchange. While the exact financial impact remains elusive due to the secretive nature of these transactions, experts suggest that the ramifications are dire, further straining Sri Lanka’s economic predicament.

Legitimate businesses find themselves at a disadvantage, unable to compete with the reduced prices of grey market goods. These goods bypass the legal channels of importation, evading tariffs and taxes, and thus can be sold at a lower cost. This creates a skewed market where authorised distributors and retailers struggle to maintain their foothold.

Consumers, drawn by the initial savings, may face higher expenses in the long run. Grey market products often lack warranties and after-sales support, leaving buyers with few options if issues arise. The government recognises the need for a comprehensive strategy to combat these imports, focusing on regulatory enforcement, consumer education, and support for legitimate businesses.

The situation calls for urgent action to protect the nation’s fiscal health and ensure a fair market for all. The government’s efforts to curb grey market activities are pivotal in fostering a resilient and fair economy. While the short-term gains of grey market products may seem beneficial, the long-term consequences pose a significant threat to Sri Lanka’s economic future. The country stands at a crossroads, where decisive measures against the grey market could pave the way for a more stable and sustainable economy.