(LANKAPUVATH | COLOMBO) –The Inland Revenue Department has decided to receive personal income tax records only through online starting from the tax year 2023-2024, which begins from April 1.

This decision has been taken with the aim of not only increasing the income but also providing convenience to the tax payers by working to get the income tax reports promptly and systematically to the department.

Income tax payers are allowed to submit their completed forms manually or online for the tax year 2022-2023. The Department said the relevant forms are accepted till November 30 for the tax year 2022-2023.

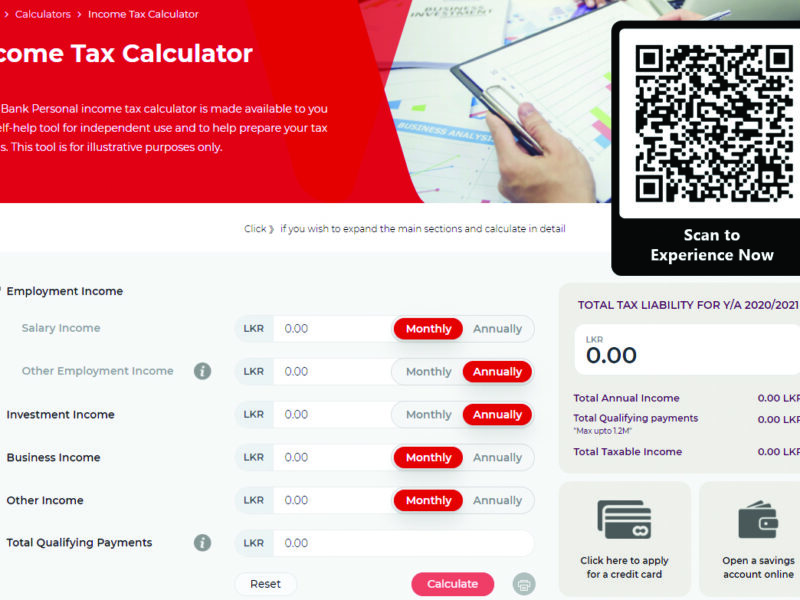

Individuals, earning more than Rs 1.2 million per year, are liable to pay the income tax and their tax files are registered with the Department. Based on a self-assessment method, they have to calculate the tax amount they have to pay and inform the Department.

Companies, which are paying the income tax, already file their tax reports online to the Department. It has been made mandatory to send their tax reports online for 2022-2023.